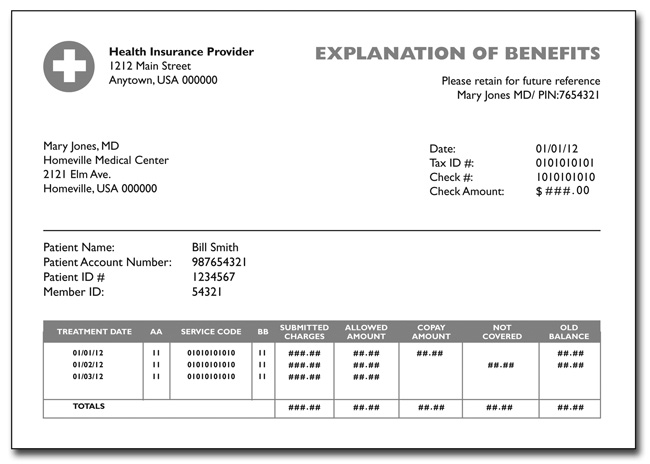

So, what is an Explanation of Benefits and why do you receive this from your Insurance carrier? The form is documentation of how a claim for health services were processed. The form provides you information on what services you received, what the health provider charged for those services and then, according to your health insurance policy, what money you owe the medical provider after the insurance adjustment. Makes sense, right? Well, why are these things so doggone hard to figure out, then?!

Again, there are some terms that you need to understand that will help you decode your EOB:

- Procedure Code or CPT – This code tells the insurance carrier what service you received from your medical provider.

- Amount Billed/Amount Submitted – This is the cost of the medical service that was billed to the insurance carrier by your medical provider.

- Not covered – This term refers to medical services that are not covered by your health insurance policy. For example, most insurance policies don’t cover cosmetic procedures like face lifts.

- Or, if you were injured at work, your personal health insurance would not cover any medical services. Work injuries need to be filed under your organization’s Worker’s Compensation policy.

- Discount – The reason individuals and organizations purchase their health insurance through groups is to receive discounts on the services. Similar to joining Sam’s Club or Coscto, your membership in that group {i.e. Medical Mutual, UnitedHealthcare, Cigna, etc.} gets you discounts. The discount reflects the amount taken off from the amount that was billed by your medical provider to your insurance carrier.

- Deductible – A deductible is the amount you need to pay first before your insurance starts to pay on your medical services. The deductible is calculated AFTER any discounts you receive from your insurance carrier. Deductible dollar limits can vary from $500 to $10,000. Once your deductible has been met, meaning you have paid for medical services up to that dollar limit, your plan can do one of two things: (1) start paying the rest of your medical expenses at 100% or (2) you have a co-pay. We will discuss co-pays...

- Co-insurance – A co-insurance is when the insurance carrier shares the cost of medical services with you. Co-insurances generally go into effect after you have met your deductible. The cost sharing can depend on a couple of things: (1) your insurance policy and (2) whether you received services inside or outside of your network. Generally, if you choose services inside your network your co-pay will be less than if you went outside the network.

- Network Providers - The network is the group of medical providers that your insurance carrier has negotiated discounts with. So they are able to share those savings with you.

- Co-payment – Yes this is different than co-insurance. Confusing, right? Co-payments are the flat dollar amounts that your insurance plan may require you to pay for each office visit. These can vary from $10 to $35 per office visit. Unfortunately, co-payments are not included in your deductible, co-insurance or maximum out of pocket expenses. Co-payments are generally just for office visit charges and do not apply to other medical services you might receive.

- Maximum out of pocket – Maximum out of pocket is the maximum dollar amount that you will spend on medical services each year. The Maximum out of pocket number is a total of your deductible and your portion of the insurance co-pay. *A reminder that Deductibles and Co-insurance are annual amounts. You start back at zero at the beginning of your insurance year, which often follows the calendar year.

- Patient Responsibility – This amount if what you owe the medical provider. If you have met your deductible and co-insurance, this amount could be zero. But if you have not paid out the maximum out of pocket amount, you will have an outstanding balance.

Phew! That was a lot of information for one blog post... Still have questions? Send me them below or if you would rather email them to me, please do at [email protected]

The next blog post will go over what to do if you think there is a mistake.

RSS Feed

RSS Feed