Really, end of life planning is just another form of insurance. We buy health insurance, not because we want to get sick. We pay for car insurance, not because we plan on getting into a car accident. So, why don’t we want to “insure” our final wishes?

This is a difficult topic to discuss, but lack of planning could have significant effect on your loved ones. So we are going to talk it!!

When is the best time to conduct end of life planning? NOW. Not later, not in a few years, but NOW!! If you are over 18 years of age, your final wishes need to be documented. Not just shared with family members, but recorded in a legal format.

End of life planning is much more than wills. There are other documents that can be just as important in ensuring your final wishes are followed. I want to discuss just a few of them.

Medical Power of Attorney

This link is a sample Medical Power of Attorney. This legal document allows someone to make medical decisions on your behalf, if you are incapacitated. They are the individual you have chosen to carry out your wishes on issues like artificial nutrition or hydration, Do Not Resuscitate (DNR) orders, comfort care or life sustaining treatments. This form is for medical decisions only and does not impact any financial or personal assets.

Financial Power of Attorney

Review a Financial Power of Attorney, otherwise known as a Durable Power of Attorney.

This legal document allows you to appoint someone to take care of your financial affairs. This can include items such as: real estate, stocks, bonds or other financial investments, insurance or retirement funds, bank accounts, business accounts, and other financial related items. The individual that you appoint as your Durable Power of Attorney does not have to be the same person you appoint as your Medical Power of Attorney. They also do not necessarily have to be a relative. But they do need to be someone that is able to carry out these duties.

Wills, Trusts and other Legacy Planning documents

Wills, Trusts and other Legacy Planning documents are all various ways to plan for the disbursement of all of your assets after you die. There are numerous methods and formats individuals can use. There are many attorneys or financial planners that can help you determine the best structure for your individual situation. You should select someone that has experience with end of life planning.

Starttheconversation.org has wonderful resources to help you have end of life planning conversations with your loved ones. Creating an end of life plan for yourself is the final gift you can give to your loved ones.

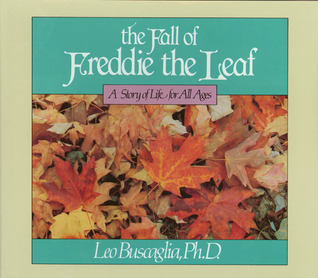

Do you have little ones? This book written by Leo Buscaglia, Ph.D. is a beautiful story about a leaf and it helps to put death into perspective. It's even a good reminder for us all....

RSS Feed

RSS Feed